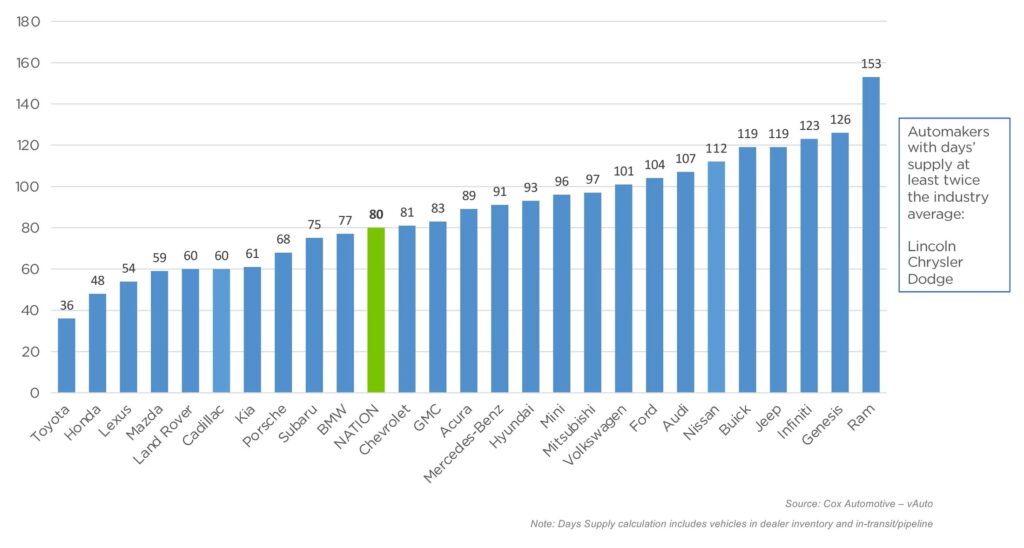

A backlog of vehicles is accumulating on dealer lots nationwide as, for the first time since June 2020, there are 80 days of new vehicle supply throughout the automotive industry. This follows a weak sales performance in January and the normalization of supply lines.

window.ramp.que.push(function () {

window.ramp.addTag(“pwMobiMedRectAtf”);

})

The days’ supply metric is one of many used by analyst to gauge the health of the automotive market, and measures the number of vehicles on dealer lots and in transit from the factory. Although the figure is complicated by the after effects of the pandemic (which devastated vehicle supply), more days of supply generally correlates with weaker demand for new vehicles.

So it will be of concern to dealers that the average number of days of supply at the start of January hit 80, up 38 percent from a year earlier, new data from Cox Auto shows. In fact, the last time days’ supply was higher was in the early days of the pandemic, before chip shortages rocked the industry. In June 2020, the industry had 83 days’ supply of vehicles across the nation.

advertisement scroll to continue

window.ramp.que.push(function () {

window.ramp.addTag(‘pwDeskMedRectAtf’);

})

window.ramp.que.push(function () {

window.ramp.addTag(“pwMobiMedRectBtf1”);

})

Read: Owning A New Car Becoming A Fantasy For Millions Of Americans Making Under $100K

However, dealers will likely take comfort in the fact that there were simply more vehicles available to sell in the first month of 2024, than there were in the first month of 2023. Although there were 2.61 million unsold new vehicles available around the country at the start of February — around 50 percent, or 870,000 more units than were available a year earlier — sales were also up 9 percent as compared to a year ago.

The good news is that higher supply is being felt on the price sheet. At the start of February, average listing prices across the industry fell to $47,142, down 1 percent from a year earlier. Prices fell significantly in the second half of January, as harsh weather disrupted sales during what is already one of the lower volume months of the year in terms of auto sales.

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-a-mid’,

container: ‘taboola-mid-article’,

placement: ‘Mid Article’,

target_type: ‘mix’

});

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-oc-2×1’,

container: ‘taboola-mid-article-thumbnails-organic’,

placement: ‘Mid Article Thumbnails Organic’,

target_type: ‘mix’

});

Moreover, dealers are working harder to sell their vehicles. Listing prices are falling by about 1 percent per week, and discounts have been growing. Incentives averaged 5.7 percent of average transaction prices in January, which is nearly twice what they were in January 2023.

The Best And Worst By Brand

By group, Stellantis was the automaker with the greatest supply surplus. Chrysler and Dodge both have more than 160 days’ supply (twice the industry average), as does LiIncoln, while and Ram and Jeep are only performing a little better at 153 days, and 119 day, respectively. Genesis and Infiniti aren’t doing much better either at 126 and 124 days respectively.

Detroit’s big three all have high inventory. Lincoln also has more than 160 days’ supply, while Buick, Ford, GMC, and Chevrolet all have more supply than the industry average, at 119, 104, 83, and 81 days, respectively.

Ford and Chevrolet both have some highly sought after vehicles, though. The Maverick and the new Trax are both flying off the lots, and are two of the vehicles with the lowest days’ supply, behind the Toyota Grand Highlander, which tops the charts. Indeed, the vehicles with the shortest supply come from Japanese automakers. Toyota has just 36 days’ supply, while Honda has 48, and Lexus has 54.

Source link

#Weak #Sales #Lead #Biggest #Inventory #Pandemic #Stellantis #Drowning #Unsold #Cars